Palladium Price

Palladium is mostly associated with platinum, although it doesn’t quite match the fame of the latter. But it is quite well-known in the finance industry. In fact, it’s been on the financial news in the first week of March, as having outperformed gold and silver.

Palladium was discovered only in 1803, and it is part of the platinum group metals (PGMs) which also include platinum, osmium, iridium, ruthenium, and rhodium. They all have very similar chemical properties. However, palladium is the least dense of them all, and it also has the lowest melting point.

Its main applications are in the automotive industry. It’s very rare, and recycling contributes a significant percentage of the world supply. Because of its scarcity and because it is very valuable in the automotive industry, it has become a very interesting financial investment in the world market today.

Below is the historical Palladium price per troy oz.

| Year | Price | Price (Inflation Adjusted) | Change |

|---|---|---|---|

| 1968 | $46.31 | $337.82 | 0% |

| 1969 | $38.19 | $264.07 | -21% |

| 1970 | $35.78 | $234.06 | -7% |

| 1971 | $35.04 | $219.56 | -2% |

| 1972 | $47.74 | $289.86 | 27% |

| 1973 | $75.45 | $431.36 | 37% |

| 1974 | $126.26 | $650.32 | 40% |

| 1975 | $66.28 | $312.91 | -90% |

| 1976 | $47.21 | $210.66 | -40% |

| 1977 | $49.34 | $206.73 | 4% |

| 1978 | $63.00 | $245.32 | 22% |

| 1979 | $119.83 | $419.24 | 47% |

| 1980 | $200.78 | $618.90 | 40% |

| 1981 | $94.58 | $264.32 | -112% |

| 1982 | $66.83 | $175.86 | -42% |

| 1983 | $136.16 | $347.19 | 51% |

| 1984 | $148.18 | $362.26 | 8% |

| 1985 | $105.76 | $249.57 | -40% |

| 1986 | $115.96 | $268.54 | 9% |

| 1987 | $129.95 | $290.48 | 11% |

| 1988 | $123.28 | $264.72 | -5% |

| 1989 | $143.70 | $294.43 | 14% |

| 1990 | $113.95 | $221.51 | -26% |

| 1991 | $86.93 | $162.18 | -31% |

| 1992 | $87.12 | $157.80 | 0% |

| 1993 | $120.30 | $211.55 | 28% |

| 1994 | $141.62 | $242.73 | 15% |

| 1995 | $149.94 | $249.99 | 6% |

| 1996 | $127.35 | $206.14 | -18% |

| 1997 | $172.40 | $272.79 | 26% |

| 1998 | $262.78 | $409.25 | 34% |

| 1999 | $358.02 | $545.58 | 27% |

| 2000 | $680.79 | $1,003.32 | 47% |

| 2001 | $603.86 | $865.71 | -13% |

| 2002 | $337.57 | $476.33 | -79% |

| 2003 | $200.27 | $276.24 | -69% |

| 2004 | $229.37 | $308.06 | 13% |

| 2005 | $201.37 | $261.56 | -14% |

| 2006 | $320.27 | $403.10 | 37% |

| 2007 | $354.86 | $434.47 | 10% |

| 2008 | $351.51 | $414.61 | -1% |

| 2009 | $263.27 | $311.78 | -34% |

| 2010 | $525.51 | $612.54 | 50% |

| 2011 | $733.30 | $828.23 | 28% |

| 2012 | $643.53 | $711.89 | -14% |

| 2013 | $725.13 | $790.31 | 11% |

| 2014 | $803.10 | $861.50 | 10% |

| 2015 | $691.01 | $740.52 | -16% |

| 2016 | $612.04 | $641.14 | -13% |

| 2017 | $750.79 | $768.81 | 18% |

| 2018 | $1,036.95 | $1,036.95 | 28% |

Price History of Palladium

The price of this metal has increased sharply since 1996, and its price approached the $300 mark by 1998. Today (or at least on March 9, 2016), its price is at $555.50 per ounce. Palladium prices have reached its highest levels since 2001.

What accounts for these attractive prices? Historically, it has all been about supply and demand, although politics and government policies can affect these factors.

Palladium is extremely rare, so any disruption in the supply can have far-reaching consequences. Only 200,000 ounces (or less than 5,670 kilos) are produced each year. While deposits of this metal can be found in various spots around the world, in practical terms the most important sources of the metal come from Russia and South Africa. Russia produced 87,000 ounces in 2010, while South Africa accounted for 73,000. The US came in at a distant third, with just 11,600.

A notorious instance of supply disruption for the metal occurred in late 2000, when the supply from Russia was delayed because for political reasons the export quota was not granted in time. That disruption caused a buying spree in the market, and the price rose to a record high of $1,100 per troy ounce in January 2001.

The Ford Motor Company panicked and stockpiled the metal, which they bought near the peak prices. They were afraid that the disruption would affect their production. But the price of the metal soon fell afterwards when the supply lines stabilized. The stockpiling of the metal caused an estimated $1 billion loss for the automotive giant.

The other factor is the demand, and that has been increasing steadily since the 1990s. At the time of the Russian supply disruption, the world demand for the metal rose from 100 tons in 1990 to almost 300 tons in 2000.

The demand for the metal is rising steadily, because the Chinese premier has recently announced that the government will focus on growth and development. That implies a greater need for palladium in the future, because the country will experience a surge in automotive sales.

Palladium as Investment

The metal is considered an attractive investment for 2 main reasons. The first reason is that like gold it can act as an inflation hedge and safe haven. The other reason is that investing in the metal is akin to betting on the continuous growth in emerging markets. As the developing world increases its purchases of cars, then there would be a greater demand for the metal.

On the downside, as Russia is the main supplier for the world market it is very easy to disrupt the market supply. Russia is involved in world politics and it does not always agree with Western policies. If the West imposes any sanctions that can choke the export of this metal, then this can only intensify the predicted deficit in the supply.

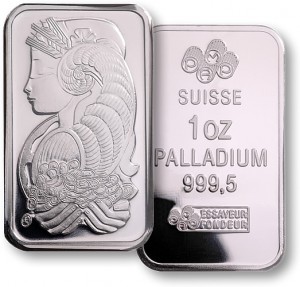

You can invest in palladium in several ways. Because it is very valuable on a per-ounce basis, you can always just buy and store the metal. You can try to get it at a low price and then sell it when the price rises. You won’t have to deal with the complexities of trading in futures contracts, but you will have to cover the cost of the storage. You can buy the metal as coins or bars in the US and Canada.

Futures are also traded in the New York Mercantile Exchange. For June delivery, the price rose to $577.60 an ounce. The contract size is 100 troy ounces per futures contract.

As an investor, you can also buy stocks in the companies that extract or sell this metal. The values of these stocks tend to rise when the price of the metal goes up, especially when the company has steadied its production costs.

Finally, you can also buy stock in ETFs or exchange-traded funds. These are the funds that engage in investing in the metal in various way.

Purposes Used For

Palladium has a variety of uses. It has been used as electrodes in electronics, as a means to store hydrogen, as part of the fillings in dentistry, and even as jewelry.

But the most common use for the metal is for making catalytic converters in automobiles, which convert harmful gases into less-harmful substances. It is this use which has made it an integral part of the automotive industry.